Why You Shouldn’t Use Venmo 3 Shocking Reasons Must Read

The Hidden Costs of Convenience: Why You Shouldn’t Use Venmo

In today’s computerized age, comfort frequently comes at a taking a toll. This App, a well-known advanced wallet, epitomizes the cutting-edge comfort of moment cash exchanges. However, underneath the surface of speedy exchanges and social sharing highlights, there are compelling reasons to reexamine its utilization. This web journal post digs into the less talked about perspectives of Venmo, highlighting why it might not be the most excellent choice for your money-related exchanges.

Understanding Venmo: A Brief Overview

This App works as a peer-to-peer installment stage, permitting clients to send and get cash with ease. At first, celebrated for its user-friendly interface and social engagement features, Venmo has ended up being a staple within the budgetary schedules of numerous. Be that as it may, its comfort may well be dominated by a few basic downsides.

The Privacy Paradox

One of Venmo’s special highlights is its social bolster, where exchanges can be shared among companions. Whereas this includes a social component to budgetary intelligence, it moreover raises noteworthy security concerns. The permeability of exchanges can incidentally uncover individual exercises and monetary propensities to a broader group of onlookers than planning.

3 Shocking Reasons

1. Security Concerns and Risks

Despite its ubiquity, This App has been under examination for its security measures. Clients have detailed unauthorized exchanges and account breaches, raising questions approximately the platform’s capacity to defend monetary data.

Notable Security Breaches: Past episodes including security breaches have cleared out clients addressing the keenness of Venmo’s defensive measures. These scenes serve as stark updates on the potential dangers related to advanced wallets.

2. Hidden fees

Venmo’s charge structure, especially for moment exchanges, can capture clients off watch. These covered-up costs can amass over time, making This App a costly choice for visit clients.

Instant Transfer Fees: This App charges an expense for moment exchanges to bank accounts, a detail regularly overlooked by modern clients. This area investigates these expenses and other potential charges that might not be quickly clear.

3. Limited Consumer Protections

Not at all like conventional managing an account, This App offers constrained securities for exchanges, clearing out clients helpless in debate or cases of extortion. This need for security may be a critical downside for those depending on Venmo for critical money-related trades.

Customer Service Challenges: This App clients have detailed challenges in settling issues through client benefit, encouraging complicating circumstances where reserves are erroneously sent or in cases of account hacking.

Why You Shouldn’t Use Venmo: Personal and Financial Privacy at Risk

The mix of social media and money-related exchanges on This App postures a one of a one-of-a-kind hazard to individual and money-related security. This segment analyzes the suggestions of having an open exchange nourish and how it can influence users’ security.

The Social Media Aspect of Venmo

Venmo’s integration of social media highlights, whereas inventive, can lead to oversharing of individual data. This area examines the potential results of Venmo’s social nourishment on client security.

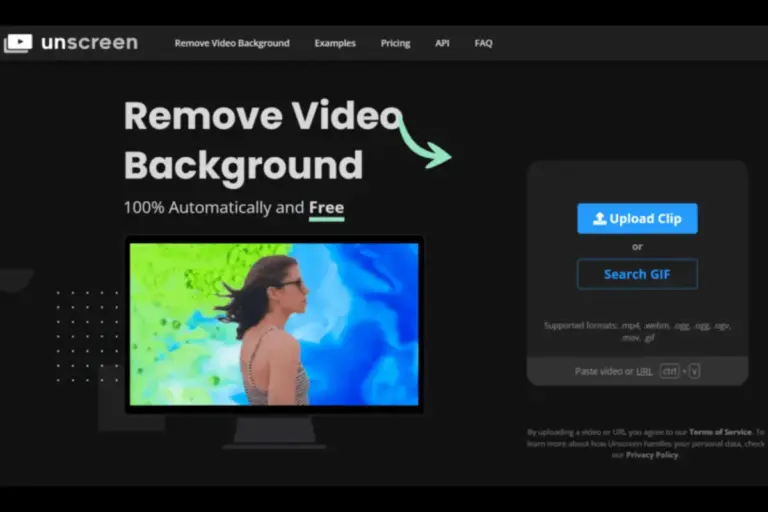

Alternatives to Venmo

For those concerned about the issues raised, several choices to Venmo offer comparative comfort without the same dangers. This segment presents more secure advanced installment choices.

Navigating the Digital Payment Landscape Safely

This portion of the article offers down-to-earth counsel for utilizing advanced installment stages like This App securely, emphasizing the significance of privacy settings and secure utilization hones.

Conclusion:

As we wrap up, it’s pivotal to reflect on the true cost of the comfort advertised by stages like This App. The issues sketched out in this post, from protection concerns to covered-up expenses, emphasize the significance of understanding the total suggestions of using advanced installment administrations. Within the advanced age, being educated is the primary step toward securing your budgetary and individual security.

FAQs

What makes Venmo different from traditional banking services?

Venmo combines social media components with budgetary exchanges, permitting clients to share their installment exercises with companions. Not at all like conventional banks, it’s planned for peer-to-peer exchanges, making it well known among more youthful clients for its straightforwardness and social perspective.

Are there fees associated with using Venmo that I should be aware of?

Yes, whereas numerous of Venmo’s highlights are free, there are particular expenses to be mindful of, such as moment exchange expenses to your bank account, which could be a rate of the exchanged sum. Standard bank exchanges are free but take longer.

How can I protect my privacy while using Venmo?

You’ll upgrade your protection on This App by altering the protection settings for your exchanges, and choosing between open, friends-only, or private. It’s too astute to routinely audit your companion list and exchange history to preserve control over your information.

Click Here For:

![Verv App Review: Features, Pros-Cons, Best Worth It? [2024] Verv App Review](https://mediatalky.com/wp-content/uploads/2024/01/Verv-App-Review-768x512.png)

![Click Millionaire App Reviews- Is This Fake Or Legit App? [2024] Click Millionaire App Reviews](https://mediatalky.com/wp-content/uploads/2024/05/Click-Millionaire.jpg)