Is Bridge Money App Legit? Complete Review, Features, and Cashback Benefits

Is Bridge Money App Legit? A Detailed Review of Cash Back Opportunities

With the rise in shopping apps advertising cashback, one app making waves is the Bridge money app. Outlined to boost your cashback on ordinary buys, Bridge Money is rapidly becoming a well-known choice for customers looking to spare cash at trusted stores like Walmart, Taco Chime, and Amazon. But with all the energy encompassing this app, one address remains:Is the Bridge Money app legit?

If you’re pondering whether this app is worth your time and how it works, you’re in the right place. In this survey, we’ll take a closer see at the Bridge money app, how it works, its key highlights, aces, and cons, and whether it’s a secure alternative for your cashback needs.

What Is Bridge Money App?

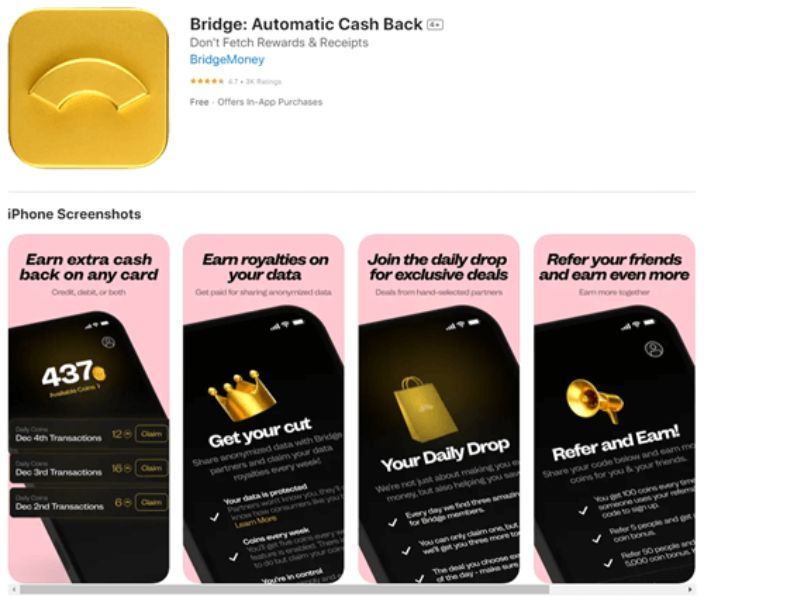

Bridge money could be a computerized stage outlined to make winning cashback on regular buys straightforward. The app turns your shopping into a reward-earning involvement by naturally following buys and giving you cashback without requiring a credit card. Instep, clients interface their charge cards to the app, which permits them to gain rewards on a wide assortment of ordinary things.

The app works with various well-known brands and retailers, including Kroger, McDonald’s, Taco Chime, Walmart, Burger Ruler, and more. By essentially interfacing your charge card and utilizing it for buys, you’ll begin collecting cashback that can be recovered over time.

How Does the Bridge Money App Work?

Utilizing the Bridge money app is inconceivably direct. Here’s how you’ll get begun and begin winning cashback:

- Download the App: You’ll download the Bridge Money app without charge from the Google Play Store or Apple App Store.

- Sign Up: Make an account utilizing your essential details, such as your title, e-mail, and phone number.

- Link Your Debit Card: The app requires you to put through your charge card. It employments your customary investing designs to calculate cash back, so there’s no requirement for you to alter your shopping propensities or go out of your way to discover bargains.

- Shop at Partnered Stores: Once your card is connected, you’ll shop at collaborated stores like Walmart, Taco Chime, Burger Ruler, and more.

- Earn Automatic Cashback: After making your buy, the app tracks it and naturally calculates the cashback you’ve earned. You’ll be able to observe your reserve funds develop over time.

- Redeem Your Cash Back: Once you’ve earned sufficient cashback, you’ll be able to recover it specifically through the app.

Key Features of the Bridge Money App

The Bridge money app offers a few highlights that make it engaging for clients trying to find a simple way to win cashback. Here’s a rundown of its key features:

- Automatic Cashback on Everyday Purchases: No have to actuate offers or hunt for bargains. Fair connect your charge card and begin gaining.

- Wide Range of Partnered Stores: From basic need stores like Kroger to fast-food chains like McDonald’s, the app bolsters a wide run of prevalent retailers.

- No Credit Card Required: Not at all like other cashback apps that require a credit card, Bridge Money works specifically along with your charge card, maintaining a strategic distance from the requirement for any credit-related concerns.

- Easy-to-Use Interface: The app’s interface is user-friendly and outlined to form it basic to track your cashback and recover rewards.

- Boosted Cashbacks: Bridge money once in a while offers boosted cashback openings, permitting clients to win more for a constrained time on certain buys.

- Referral Program: You’ll be able to win additional rewards by alluding companions and family to the app, making it indeed less demanding to maximize your cashback potential.

Is Bridge Money App Legit?

Yes, the Bridge Money app is legit. It has garnered positive audits for conveying its guarantee of programmed cashback without requiring clients to utilize credit cards. The app’s secure charge card linking and straightforward preparation for earning and recovering rewards have made it a trusted choice for numerous clients.

In any case, as with any app including budgetary exchanges, it’s imperative to be cautious. The app requires getting to your keeping money data, so make beyond any doubt to take after the best hones for securing your individual and monetary subtle elements, such as empowering two-factor verification and frequently observing your account activity.

Pros and Cons of the Bridge Money App

Like all apps, Bridge Money has its advantages and drawbacks. Here’s a breakdown to assist you choose whether it’s the correct cashback arrangement for you.

Pros:

- Automatic Rewards: No need to manually activate offers or keep track of deals.

- No Credit Card Debt: You can earn rewards with a debit card, avoiding potential credit card debt or interest charges.

- Wide Range of Stores: Earn cashback from big-name brands like Walmart, Kroger, and McDonald’s.

- Simple to Use: The app’s interface is clean and easy to navigate, making it accessible to all types of shoppers.

- Referral Program: Earn additional rewards by referring others to the app.

Cons:

- Limited to Debit Card Use: Some cashback apps offer higher rewards for credit card use, but Bridge Money only supports debit cards.

- Partnered Stores: While the app offers cashback from many well-known stores, the selection is still somewhat limited compared to other cashback platforms.

- Requires Financial Information: Linking your debit card to the app may be a concern for some users who are wary of sharing their banking details.

- No Customization: The app doesn’t allow you to select specific cashback deals or categories, limiting the personalization of your rewards.

- Cashback Takes Time to Accumulate: For some users, the cashback rates may seem small, and it can take a while to accumulate enough for a significant payout.

Pricing and Plans

Bridge money is free to download and utilize, making it accessible to anybody who wants to begin gaining cashback. There are no membership expenses or covered-up charges, which could be a major furthermore for budget-conscious customers.

Final Thoughts: Is the Bridge Money App Worth It?

If you’re searching for a hassle-free way to win cashback on ordinary buys, Bridge Money is worth considering. The app’s programmed cashback framework, lack of credit card requirements, and wide run of joined forces stores make it a genuine and helpful choice for customers. In any case, be sure of the impediments in-store selection and the got to connect your charge card.

For those who need a straightforward, set-it-and-forget-it cashback arrangement, the Bridge money app is certainly an awesome alternative. Whereas it may not offer the most noteworthy cashback rates, its ease of utilization and wide store arrangement make it an appealing choice for regular customers.

In conclusion, Bridge Money is legit, simple to utilize, and offers a strong alternative for anybody looking to spare on their standard buys.

Also Read:

- AlignUS App Review: Discover Businesses That Align with Your Values

- Todo App Review: Is This Best For Craft Lovers and Small Businesses

FAQs:

1. Is the Bridge Money app safe to use?

Yes, the Bridge money app is secure to utilize. It safely interfaces with your charge card for programmed cashback and employment encryption to ensure your monetary information.

2. How do I earn cashback with Bridge Money?

You gain cashback by connecting your charge card to the app and shopping at Joined Forces stores. The app naturally tracks your buys and applies cashback.

3. Are there any fees for using the Bridge Money app?

No, the Bridge Money app is free to download and utilize. There are no covered-up expenses or membership charges.

![How To Cancel Ebay Order- How To Get Refund [2024] How To Cancel Ebay Order](https://mediatalky.com/wp-content/uploads/2024/04/How-Does-Offerup-Work-2-1.jpg)