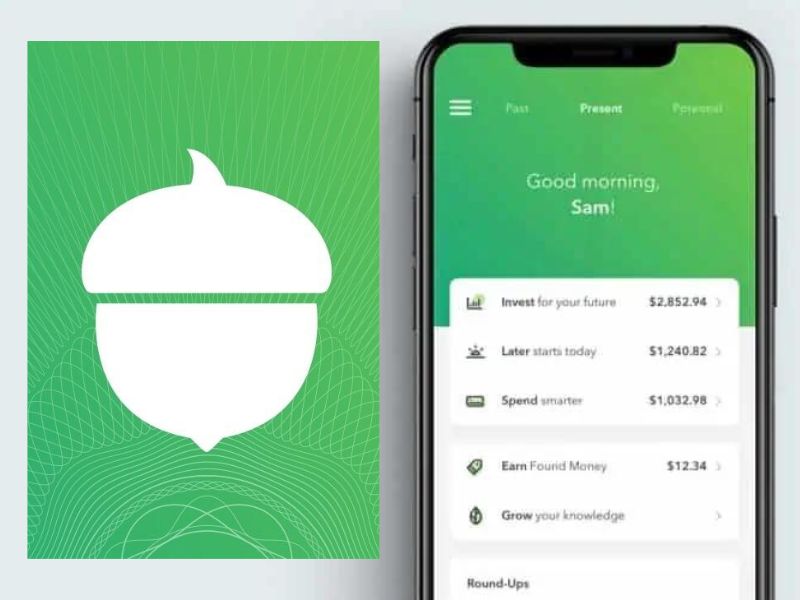

Acorns App Review: Easy Investing with Spare Change and Smart Features

In today’s investing world, Acorns continues to be a standout app that lets people invest spare change easily. Originally launched to simplify investing for everyday users, Acorns now offers a broader range of services banking, retirement, and more making it a more full-featured fintech platform than before.

What are acorns?

Acorns may be a flexible app laid out to help individuals contribute little wholes of cash. The app joins your bank account, credit cards, or charge cards and rounds up your buys to the closest dollar, contributing to the differentiation into a broadened portfolio of ETFs (Exchange-Traded Stores).

For instance, on the off chance you merely buy a coffee for $3.50, this app will round up the purchase to $4.00 and contribute the $0.50 difference. This micro-investing approach makes it basic for anyone to start contributing without requiring a tremendous aggregate of cash.

Over time, the app has added features:

-

Retirement accounts (IRAs) via “Acorns Later.”

-

ustodial / kids’ accounts via “Acorns Early.”

-

Banking / checking features with round‐ups, no overdraft fees, access to ATMs, etc.

So Acorns is no longer just micro-investing it’s evolving into an all-in-one financial companion for savings, investing, and daily banking

Key Features (2025 Edition)

Here’s what Acorns offers now, updated with new details:

-

Round-Ups / Spare Change Investing

Every purchase gets rounded up. Once the amount reaches a minimum threshold (often $5), the spare change is invested. -

Recurring & One-Time Deposits

You can also set up automatic transfers (weekly, monthly) or deposit a lump sum when you want to boost investments manually. -

Diversified ETF Portfolios

Acorns builds investment portfolios using low-cost ETFs across stocks, bonds, real estate, and even a Bitcoin-linked ETF in some tiers.

The underlying ETF expense ratios typically range from about 0.04% to 0.22% depending on allocation. -

Automatic Rebalancing

Portfolios are adjusted over time to stay aligned with target allocations, without you doing anything. -

Banking / Checking Features

Acorns offers a checking account with no overdraft fees, access to over 55,000 fee-free ATMs, and real-time round-ups from card transactions.

Some tiers also offer higher yields: for example, checking APY ~2.57% and savings / emergency fund ~4.05% on higher tiers. -

Cashback / Earn Program

When you shop through partner brands (online or in-store), Acorns gives you bonus investments (i.e. cash rewards) directly into your investment account. -

IRA & Retirement Options

Via Acorns Later, you can open Traditional, Roth, or SEP IRAs. Also, some subscription tiers offer matching contributions for IRAs (e.g. 1% or 3% match). -

Custodial / Kids’ Accounts

With the “Early” accounts, you can invest for children, manage funds for them, and set up parental controls. -

Smart Deposit / Direct Deposit Integration

You can have a part of your paycheck automatically routed into your Acorns checking or investment accounts to smooth your saving habit.

Costs, Fees & Pricing (What’s Changed)

One of the most discussed parts of Acorns is its pricing model, especially for users with small balances. Here’s the current picture:

-

Acorns charges subscription tiers rather than a percentage of account assets. Plans are:

• Bronze: $3/month

• Silver: $6/month

• Gold (aka Premium / Family): $12/month -

The flat fee can be a steep percentage cost if your account balance is small. For example, $3 monthly on a $100 balance is equivalent to a 36% annual fee.

-

ETF expense ratios are additional costs (0.04%–0.22%) that are part of the funds you invest in.

-

If you want to transfer out your investments to another brokerage, Acorns charges $50 per ETF in many cases. That can become expensive.

-

Some features like custody accounts, IRA matching, and kids’ accounts require the higher subscription tiers.

Benefits of Using Acorns

![Acorns App Review: Easy Investing with Spare Change and Smart Features Acorns: Key Features, Benefits, Potential Drawbacks [2024]](https://mediatalky.com/wp-content/uploads/2024/05/Acorns-App.jpg)

-

Easy to Get Started

No matter your background or experience, Acorns makes investing simple. The app is built for beginners, with a clean design and automation that removes the guesswork. Even first-time investors can start growing their money without stress. -

Start Small, Grow Steady

You don’t need a big amount to begin. Acorns lets you invest your spare change by rounding up purchases, and you can add recurring deposits starting at just a few dollars. Subscription plans now begin at $3 per month, making it budget-friendly for most people. -

Diversification to Lower Risk

Every dollar you invest goes into a diversified mix of low-cost ETFs. This spreads your money across stocks, bonds, and other assets so you’re not dependent on one investment. Portfolios are adjusted automatically based on your goals and risk level. -

Financial Education in the App

Through its “Grow” resources and articles, Acorns helps you learn about money while you invest. You’ll find guides on budgeting, saving, retirement, and everyday financial planning—making it easier to make smarter decisions with your cash. -

Hands-Off Convenience

With automatic round-ups and scheduled deposits, Acorns works in the background while you live your life. You don’t need to actively manage or pick investments—it’s a set-it-and-forget-it approach that builds habits and keeps your money growing.

Potential Drawbacks

1. Fees Can Add Up on Small Accounts Whereas Acorns’ expenses are generally moo, they can take a greater chomp in case you’re fair, beginning out with a little adjustment. A $1 monthly expense, for example, might not appear like much, but it’s critical in case you simply have $100 contributed.

2. Limited Investment Options Acorns sticks to a set determination of ETFs, which might not be perfect for more experienced financial specialists looking to hand-pick personal stocks or bonds.

3. No Tax-Loss Harvesting Unlike a few other robo-advisors, this app doesn’t offer tax-loss gathering, a highlight that can offer assistance and minimize charges on speculation picks up. This can be a disadvantage in case you’re seeking out more advanced charge methodologies.

Conclusion

Acorns has changed the way people think about investing, making it easy and clear for everyone especially beginners and young earners. By turning spare change into a balanced investment portfolio, it helps build the habit of saving and investing regularly.

Even though there are a few downsides, the app’s low entry point, built-in learning tools, and simple setup make it a good option for anyone who wants to start investing without needing big money or deep financial knowledge. Whether you’re just beginning your investment journey or looking for an easy way to grow your cash, Acorns gives you a practical path to reach your financial goals.

Click Here To Learn About:

- Fitbit App Review: Is It Still Worth It Without the Watch?

- Instagram Finally Lands on iPad After 15 Years of Waiting

![8 Splitting Apps like Splitwise & SplitWise Alternatives [2024] 8 Splitting Apps like Splitwise & SplitWise Alternatives](https://mediatalky.com/wp-content/uploads/2024/03/Add-a-subheading-5-768x432.jpg)