Banco do Brasil: 200 Years of Banking Excellence

Banco do Brasil: A Bank That Stands Strong With The People

When we think of a bank that has been around for ages and has earned people’s trust, Banco do Brasil (BB) is one of the first names that comes to mind. This bank is not just old; it has been serving Brazilians since 1808! King John VI of Portugal started this bank, and since then, it has helped people, businesses, and the country grow. Let’s take a look at how Banco do Brasil has shaped the financial system in Brazil and why it remains so important even today.

A Long History of Serving Brazil

Banco do Brasil started more than 200 years ago. Back then, Brazil was very different, but BB was already helping farmers, traders, and businesses get the money they needed. The bank supported the coffee industry, which was one of Brazil’s biggest exports. Over time, BB has adapted to changes, growing with the country and introducing new ways to make banking easier for everyone.

Always Bringing New Ideas

One of the biggest reasons Banco do Brasil is still popular is because it always brings new ideas to banking. It was one of the first banks in Brazil to offer online banking. This meant people could do their banking from home without visiting a branch.

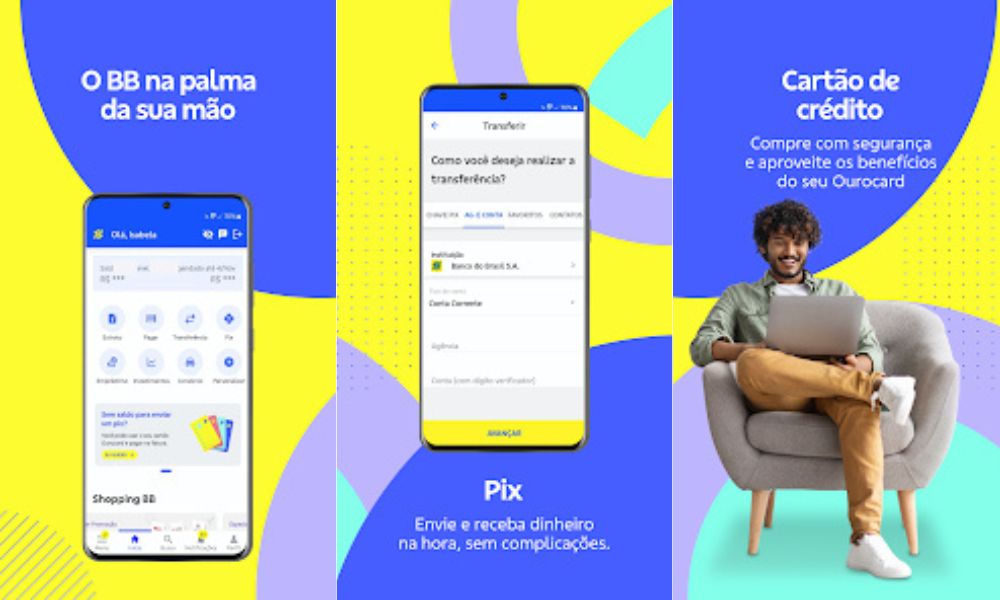

Today, BB provides many digital services. You can open an account online, transfer money through their mobile app, and access many financial tools without leaving your house. This has made life easier for customers and helped Banco do Brasil stay ahead in the banking world.

Customers Come First

Banco do Brasil understands that without customers, it wouldn’t exist. That’s why it works hard to keep them happy. Whether you need advice on saving money, taking a loan, or securing your transactions, BB offers solutions to make banking simple and smooth.

One of the popular services BB offers is the Ourocard. This credit card comes with many benefits, like cashback, discounts, and special deals. The bank also provides different investment options so customers can grow their money over time.

Pros and Cons of Banco do Brasil

| Pros | Cons |

|---|---|

| Trusted Name: More than 200 years of experience. | Old Banking Methods: Sometimes slow to change due to traditional ways. |

| Early Technology Use: Among the first to introduce online banking. | Difficult for Some: Elderly customers may struggle with digital banking. |

| Customer-Oriented:/strong> Works to provide good service. | Big System, Big Problems: Large networks can cause delays. |

| Full Range of Services: From loans to investments. | Fees Can Be High: Some services cost more than in newer banks. |

| Supports sustainability and invests in eco-friendly projects. | Tough Competition: Faces challenges from fintech and new banks. |

Helping the Environment and Communities

Banco do Brasil is not just about making money; it also helps protect nature and supports local communities. The bank has invested in renewable energy projects and helps small and medium-sized businesses grow. It also runs programs to teach people about managing their money better.

Looking Ahead

Banco do Brasil is always looking toward the future. It is working on improving its technology, bringing in new banking features, and making sure customers get the best service. Even though banking is changing fast with new digital banks and apps, BB is making sure it stays strong and continues to serve Brazilians for years to come.

Also Read:

- Chatbooks: Create Memories with Custom Photo Book

- Google Play Update: Effortlessly Find Android Apps with Widgets

Final Thoughts

Banco do Brasil has been a part of Brazilian life for over two centuries. It has survived economic ups and downs, wars, and financial crises, yet it continues to grow. From helping coffee farmers in the 1800s to offering modern banking services today, Banco do Brasil has always been there for the people. And as it keeps innovating and improving, it will remain a trusted financial partner for generations to come.