9 Apps Like Earnin- Must Try These For Instant Loans

In an era where financial management is increasingly digital, pay-as-you-go apps like Earnin have become pivotal for many looking to bridge the gap between paychecks. These apps offer a range of financial solutions, from budgeting to quick cash advances, without the stringent requirements of traditional banking systems. Here, we explore nine such apps that provide similar services, each with unique features tailored to different financial needs. Let’s talk about 9 apps like Earnin in depth.

9 Apps Like Earnin

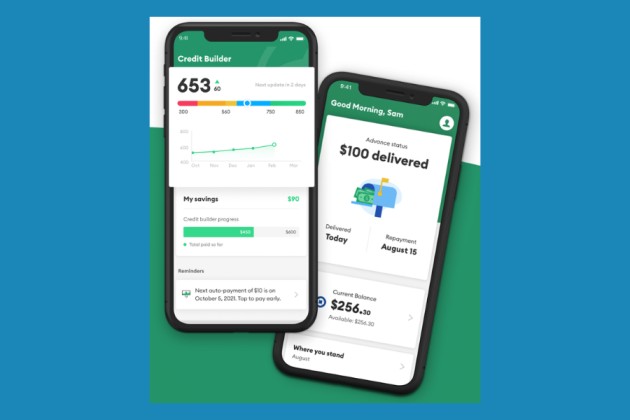

1. Dave:

Dave is fundamentally known as a budgeting app that moreover offers cash progress. It makes a difference to clients overseeing their funds by alarming them about up-and-coming bills and potential overdrafts, while moreover giving little propels to cover quick costs.

Pros And Cons

| Pros | Cons |

|---|---|

| Offers budgeting tools and financial insights | A monthly subscription fee required |

| Provides up to $100 in cash advances without interest | Limited cash advance amount compared to some competitors |

| Helps users avoid overdraft fees by predicting upcoming expenses | Users report issues with app functionality occasionally |

| User-friendly interface | Dependency on predictive algorithms, which may not always be accurate |

Payday/Cash advances

The most extreme payday development you’ll receive through Dave is $100. If you’re endorsed for money development, you’ll be able to select from the standard or express financing choices.

The standard subsidizing choice is completely free, but it might take up to three commerce days to induce money. The express financing alternative lets you get your cash on the same day, but you will be assumed to pay a little expense.

Once you’ve gotten a cash progress, you’ll not get more cash till your account is paid totally. It doesn’t survey your credit history or report your installments to credit bureaus.

How Does Dave Work?

Dave gives budgetary help basically through highlights that foresee and alarm clients around potential overdrafts. Clients can get too little cash, propelling up to $100 to cover inescapable costs sometime recently in their following paycheck. The app, moreover, makes a difference with budget administration by analyzing your investing designs and determining up-and-coming costs.

Pricing

It doesn’t charge any intrigue, but the company inquires for discretionary “tips” given by individuals who utilize the benefit. Users’ tips speak to a huge rate of the app’s income.

It as it were charges a month-to-month fee of $1, which will be deducted directly from your connected bank account each month. All things considered, you’ll be able to gain free months by making purchases at particular businesses.

2. Brigit:

Brigit is a budgetary app that gives up to $250 in cash advances as well as budgeting apparatuses and money-related tips. It’s planned to help clients remain financially steady and avoid overdraft expenses by observing their accounts and sending cautions.

Pros And Cons:

| Pros | Cons |

|---|---|

| Provides up to $250 in cash advances without interest | $9.99 monthly subscription fee |

| Offers automatic overdraft protection | The cash advance limit may not be sufficient for all users |

| Includes budgeting and credit-building tools | Requires access to your bank account and personal data |

| No late fees or penalties | Some users find customer service response slow |

Payday/Cash advances

Once you’re qualified for the credit, Brigit makes you doubt that you just can get to $250 as long as your credit card balance hits zero. It doesn’t charge any overdraft fees, and you’re free to choose the free or paid form of the app.

How Does Birgit Work?

Brigit offers up to $250 as a cash advance to avoid overdraft expenses when you’re nearing focusing out your bank account. It connects to your bank account, screens your adjustment, and consequently sends a development in case it predicts you’ll run a brief sometime recently your following payday, guaranteeing you do not overdraft.

Pricing

Brigit doesn’t charge any intrigued on payday propels, and not at all like other apps like Dave and Earnin, it’ll not provoke you to “tip.”

3. Empower:

Engage is an app that caters to those looking for a dynamic approach to budgetary administration. It offers cash advances, budgeting help, and a programmed reserve fund highlight, all aimed at engaging clients to require control of their monetary health.

Pros and Cons:

| Pros | Cons |

|---|---|

| Offers up to $250 in cash advances with no interest | Charges an $8 monthly subscription fee |

| Provides personalized financial coaching | It requires a steady income with regular direct deposits |

| Features automatic savings and budgeting tools | Some services are limited to higher subscription tiers |

| Free ATM withdrawals at over 37,000 locations | Limited availability of some features depending on the user’s location |

Payday/Cash advances

It gives you cash progress up to $250 for all qualified individuals with zero intrigued, and it doesn’t charge any intrigued, late expenses, or perform a credit check.

Keep in mind that to qualify for a cash progress with Enable, there are certain criteria for cash progress capability such as your account must be sound and dynamic for at slightest 60 days with a least $500 normal month-to-month pay and three repeating stores of $200.

How Does Empower Work?

Enable acts as an individual back coach by providing users with cash propels of up to $250, budgeting instruments, and personalized monetary recommendations. Users get a spending tracker and investment fund tips based on their financial habits, together with the progress to cover short-term costs, without being intrigued.

Pricing

There are no covered-up expenses, no overdraft expenses, no support expenses, and no insufficient fund fees with the Enable Card account. In any case, it charges $8 per month to get to all the features like keeping money and budgeting instruments.

You can also attempt its 14-day free trial period and when your trial period is over, you will be charged $8 each month. It too charges a 1% foreign trade charge of the full exchange sum.

4. MoneyLion:

MoneyLion may be a multifunctional financial platform advertising a run of administrations from managing an account and cash propels to contributing and monetary exhortation. It points to supplying a comprehensive monetary arrangement for clients looking to oversee, develop, and get to their cash.

Pros And Cons:

| Pros | Cons |

|---|---|

| Offers a full suite of financial products including loans and investments | Some features require a paid membership |

| Provides small cash advances with no interest | Fees associated with investment accounts and loan products |

| Offers rewards for healthy financial behaviors | The app can be complex for users new to financial management |

| 24/7 customer support is available | High fees on certain financial operations such as expedited fund access |

Payday/ Cash advances

MoneyLion offers credits up to $1,000, which depends on your condition. The APR ranges from 5.99% to 29.99 and comprises your MoneyLion Also participation charge.

Keep in mind that your installment can be higher based on the amount you borrow and the APR you’re given.

By utilizing the ‘Monthly Reimbursement Calculator’, you can foresee your loan’s conceivable fetched and month-to-month reimbursement.

How Does MoneyLion Work?

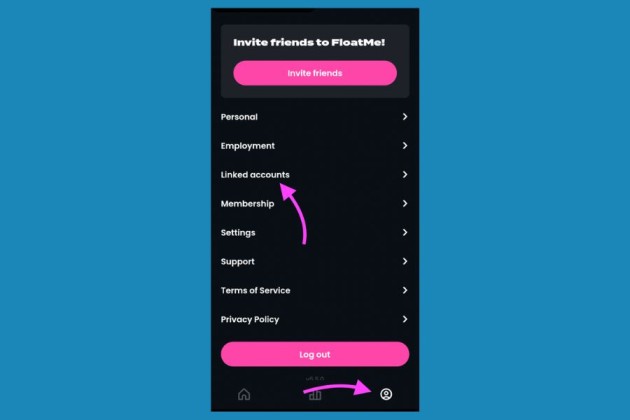

FloatMe makes a difference in clients overseeing their accounts by advertising bits of knowledge into their investing designs and giving little cash propels to assist cover critical costs sometime recently payday, pointing to anticipated overdrafts and late expenses.

Pros And Cons:

| Pros | Cons |

|---|---|

| Provides small cash advances up to $50 | Limited to a maximum of $50, which may not cover all emergency expenses |

| Low monthly fee and no interest on advances | Requires a linked bank account for operation |

| Helps users track their finances and spending | Only available in select countries |

| Quick and easy access to funds | Not suitable for larger financial emergencies |

Payday/ Repaying Advance

Your payback date is bolted in once you take a progress, but in the event that you want to change, you wish to inform them at the slightest 48 hours sometime recently your reimbursement date.

How Does FloatMe Work?

FloatMe gives budgetary bits of knowledge and little cash progresses up to $50 to assist clients oversee until their following payday. The app interfaces with your bank account to screen your equalizations and costs, advertising progresses when you’re at the chance of overdrawing your account.

Pricing

It charges a month-to-month enrollment expense that costs $1.99 a month. Separated from this, you do not have to be paid for intrigued and thus have total access to programmed reserve funds and overdraft alarms. You’ll also attempt its 30-day free trial and have full get to each include it needs to offer.

Since it is one of the slightest costly memberships for a payday development, it can be the leading alternative for you additionally, its sparing alternatives and overdraft assurance make it more worthwhile.

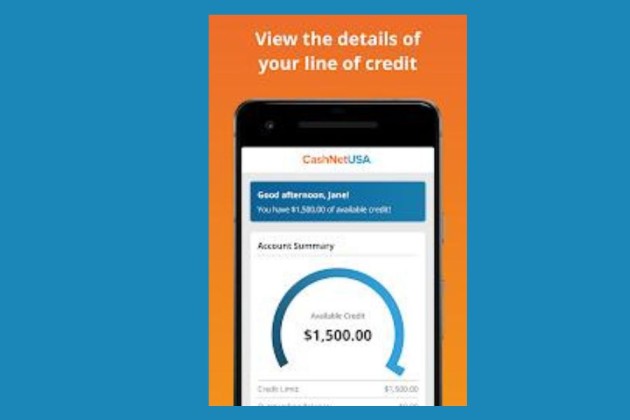

CashNetUSA offers short-term advances and lines of credit to people who require fast access to cash for crises. It gives a clear application handle with immediate financing alternatives, pleasing critical monetary needs.

Pros And Cons:

| Pros | Cons |

|---|---|

| Rapid disbursement of funds, often within the same day | High interest rates compared to other lending options |

| Offers larger loan amounts than typical pay advance apps | Fees and terms can be complex and vary significantly by state |

| Available in many states across the U.S. | Not suitable for long-term financial solutions due to high costs |

| Straightforward application process | This can lead to a debt cycle due to reliance on continuous borrowing |

Payday/ Cash advances

All the accessible credit amounts can shift from state to state and payday advances more often than not come in sums extending from $100 to $600, though installment credits extend from $100 to $3,500.

How Does CashNetUSA Work?

CashNetUSA offers short-term loans and credit lines straightforwardly to consumers who require prompt get to cash. After an application is handled, affirmed clients can get reserves rapidly, in some cases inside the same day, which are at that point reimbursed on a pre-agreed plan with intrigue.

Pricing

CashNetUSA charges an expense for each cash borrowed. These loan fees and the reimbursement terms will totally depend on the put you live.

It comes with high interest rates extending from 85.00% APR to 449.00% APR, hence making your credit very expensive.

7. Chime:

Chime could be a budgetary innovation company that provides money administrations planned to assist clients with spare cash and getting to their paychecks early. With no hidden expenses, Chime is well known among those seeking an elective to conventional banking institutions.

Pros And Cons:

| Pros | Cons |

|---|---|

| No overdraft fees, no minimum balance, and no monthly fees | Features might be more limited than traditional banks |

| Early direct deposit allows access to pay up to two days early | Some users report issues with account lockouts |

| Offers automated savings tools and a credit builder program | Dependent on network availability for card transactions |

| Fee-free ATMs at over 38,000 locations | No physical branches, which can be a disadvantage for some users |

Payday/ Cash advances

Indeed in spite of the fact that Chime gives a cash progress of up to $200, it actually begins out with as it were a $20 development or overdraft. It’ll store your paycheck as before long as your manager deposits it into your account. You’ll pull back your progress two days sometime recently the customary payday.

How Does Chime Work?

Chime could be a fintech app that gives no-fee-keeping money administrations such as investing accounts, reserve funds accounts, and a credit builder program. One of its standout features is the capacity to coordinate store installments up to two days early, together with automated saving instruments that circular up buys to the closest dollar for investment funds.

Pricing

Even though Chime’s investing account is entirely free, it does charge $2.50 for each exchange at an out-of-network ATM, and you’ll have to store cash at the Green Dot area, which may charge a charge.

It moreover doesn’t charge any month-to-month charge, overdraft charge, or benefit expenses and doesn’t require any least adjustment.

8. Vola Finance:

Vola Fund specializes in making a difference in college understudies and youthful adults overseeing their finances. It offers small propels, budgeting instruments, and personalized suggestions to assist clients in exploring their financial journey.

Pros And Cons:

| Pros | Cons |

|---|---|

| Designed specifically for college students and young adults | Advance limits are lower (up to $300) compared to other apps |

| Offers budgeting tools and predictive analytics on spending | A monthly subscription fee is required even for basic services |

| Helps avoid overdraft fees by providing small advances | Primarily benefits a niche market—students and recent grads |

| Provides educational content on financial health | Limited functionality beyond the student-oriented services |

Payday/ Cash advances

The maximum sum you can access through Vola Back is up to $300 with zero intrigued.

How Does Vola Finance Work?

Fundamentally outlined for college understudies, Vola offers advances up to $300 based on predictive algorithms that evaluate users’ investing behaviors and profit. The app too incorporates instruments for budgeting and money-related arranging, custom-made to help students oversee their funds effectively.

Pricing

Even though the app is free to utilize, Vola charges a month-to-month participation charge. The foremost essential enrollment arrangement begins at $4.99, and it states that the normal subscription charge is $7.99.

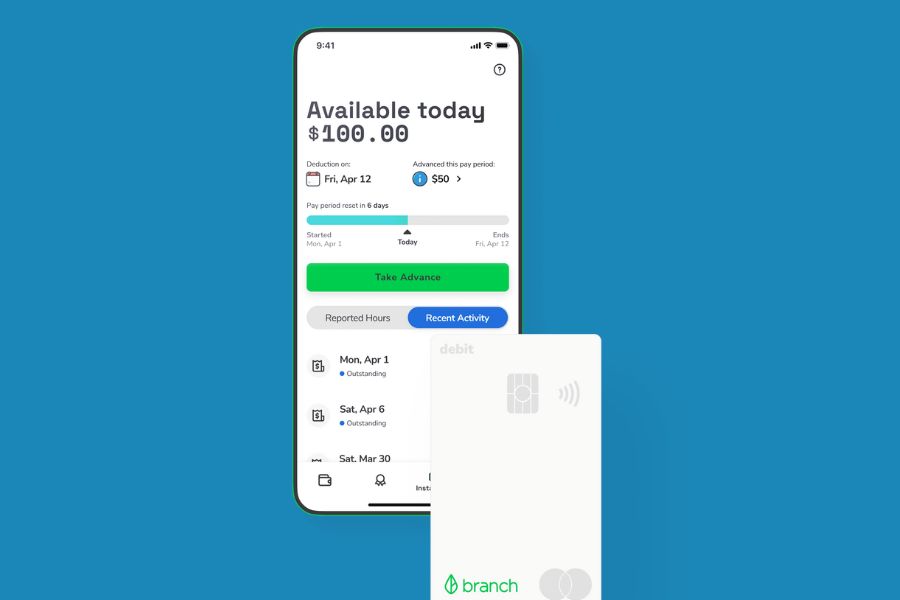

9. Branch:

The department is a monetary wellness app that gives instruments for bosses to streamline installments and empower their representatives. It offers fee-free checking accounts, charge cards, and moment access to earned compensation, improving the budgetary stability of workers.

Pros and Cons:

| Pros | Cons |

|---|---|

| Provides fee-free instant access to earned wages | Services are limited to employees of partnered companies |

| No fees for digital wallets, checking accounts, or debit cards | Advance amounts are dependent on hours already worked |

| Helps improve financial wellness through budgeting tools | Not available to freelancers or self-employed individuals |

| Offers additional workplace tools like shift scheduling | Some users may find the app’s features too basic for comprehensive financial management |

Payday/ Cash advances

The most extreme sum you’ll access on any day through Branch is $150 and the greatest you can get per pay period is $500. The sum you’re eligible for is more often than not dependent on the number of hours you work and the compensation due.

How Does Branch Work?

The department centers on progressing the financial wellness of hourly laborers by giving them development to earn compensation. Clients can pull back a portion of their earned compensation sometime recently on their official payday. department too offers extra financial tools, counting budgeting helps and individual finance management, integrated into its stage for employers and representatives.

Pricing

It doesn’t charge any intrigued late charge or participation, but it may require you to leave a tip in trade for the benefit.

In case you need to get to your money rapidly, you might have to pay. It charges $2.99 to $4.99 for a moment to progress to your connected charge card or bank account, based on your transfer amount.

In any case, it doesn’t charge any expense for the standard advance, but it might take up to three trade days to get the cash.

Conclusion: Choosing the Right Pay Advance App

When selecting a pay progress app, it’s vital to consider your specific budgetary needs, the expenses included, and the terms of benefit of each app. Apps like Dave and Brigit are extraordinary for little propels and budget administration, while MoneyLion and Empower offer more strong monetary administrations. Consider what each app specializes in—whether it’s moo expenses, higher advance amounts, or custom-fitted administrations like those advertised by Vola for understudies. Make sure to peruse client audits and get the fee structure sometime recently committing to any platform.

Frequently Asked Questions

1. Are pay advance apps safe to use?

Yes, legitimate pay progress apps use bank-level security measures to protect your data but continuously survey their protection approaches.

2. How quickly can I receive funds from these apps?

This varies by app, but some, like CashNetUSA and Chime, can offer reserves nearly quickly.

3. What are the alternatives to using pay advance apps?

Options incorporate conventional loans, credit cards, inquiring for compensation advances directly from your boss, or tapping into savings.

4. Do these apps affect my credit score?

Most pay advance apps don’t influence your credit score as they don’t require a credit check. In any case, continuously confirm this with the app supplier.

Click Here To Learn:

![Why Is AliExpress So Cheap? The Secrets Behind Its Bargain Prices [2024] AliExpress](https://mediatalky.com/wp-content/uploads/2024/03/ce4b76e4-aabf-4b2d-886b-6ee7c76a9b5f-1-768x439.jpg)

![How Much Is Disney Plus- Price In US, Uk, Australia, Canada, New Zealand [2024] How Much Is Disney Plus](https://mediatalky.com/wp-content/uploads/2024/04/How-Much-Is-Disney-Plus-768x461.jpg)